By Muflih Hidayat on February 11, 2026

Strategic Supply Network Reshaping America's Critical Mineral Independence

Defense contractors and technology manufacturers face unprecedented vulnerability in their semiconductor supply chains through dependence on a single mineral that most Americans have never heard of. Gallium, a silvery metal that melts at body temperature, has quietly become the linchpin of modern military radar systems, 5G telecommunications infrastructure, and advanced electronic warfare capabilities. Furthermore, this strategic dependency represents one of the most severe supply chain risks facing American national security today, driving the development of a comprehensive US gallium strategy.

The semiconductor industry’s evolution toward higher frequencies and extreme operating conditions has made gallium compounds irreplaceable in applications where silicon-based alternatives simply cannot perform. From satellite communications operating in the vacuum of space to military systems requiring split-second response times, gallium’s unique properties have created a technological dependency that translates directly into geopolitical vulnerability.

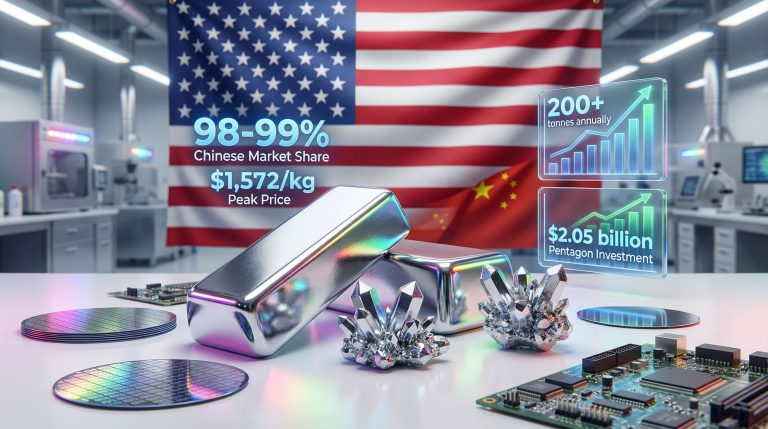

Current market dynamics reveal the extent of this strategic exposure: China controls 98-99% of global gallium supply through its integrated aluminum processing infrastructure, while global production reached only 760 tonnes in 2024. This concentration creates systemic risks that extend far beyond normal commodity market fluctuations, affecting everything from defense procurement to consumer electronics manufacturing.

What Makes Gallium America's Most Vulnerable Critical Mineral?

The Strategic Importance of Gallium in Modern Defense Systems

Gallium’s military significance stems from its superior performance characteristics in high-frequency semiconductor applications where traditional silicon technology reaches fundamental physical limitations. Heat tolerance, power efficiency, and moisture resistance establish gallium compounds as essential materials for next-generation defense systems requiring operation under extreme conditions.

Military radar systems depend on gallium-based semiconductors for detection capabilities that silicon alternatives cannot achieve. The material’s ability to operate at frequencies exceeding what silicon can handle enables radar systems with enhanced range, accuracy, and target discrimination. Similarly, satellite communications systems rely on gallium components for thermal stability in space environments where conventional cooling methods are unavailable.

Electronic warfare systems represent another critical application domain where gallium’s properties prove irreplaceable. The ability to process high-frequency signals with minimal power loss enables jamming and countermeasure capabilities that provide decisive tactical advantages. Additionally, these applications explain why gallium supply security has become classified as a national security priority rather than merely an industrial concern.

Beyond military applications, gallium enables the 5G infrastructure that supports both civilian communications and dual-use technologies. Moreover, the transition to 5G standards requires components operating at frequencies that necessitate gallium compounds, creating structural demand growth independent of defense requirements.

China’s Near-Total Market Dominance Statistics

China’s control over gallium supply stems from its dominance in aluminum and alumina refining capacity, where gallium occurs as a recoverable trace element rather than through dedicated gallium mining operations. This integration allows China to control gallium availability through its broader aluminum industry strategy rather than requiring specialised gallium extraction investments.

The timeline of supply restrictions demonstrates the vulnerability this creates:

- 2023: China implements initial export controls on gallium

- 2024: US-bound shipment restrictions (currently suspended but subject to reinstatement)

- January 2026: Gallium prices reach $1,572 per kilogram, representing a 300% increase from pre-restriction levels

These price movements reflect market distortion beyond normal commodity cycles. The small scale of global gallium production amplifies price volatility, with total worldwide output of 760 tonnes in 2024 representing a market smaller than many individual industrial facilities’ annual consumption of bulk commodities.

Current pricing dynamics reveal the extent of supply chain disruption. Vice President JD Vance characterised the situation as reflecting market conditions that punish strategic investment and diversification efforts. This assessment captures how Chinese export controls have created artificial scarcity that discourages legitimate supply chain development through traditional market mechanisms.

The integrated nature of gallium recovery from aluminum processing gives China structural advantages beyond simple production capacity. Since gallium extraction represents a secondary revenue stream from primary aluminum refining, Chinese producers can adjust gallium availability based on strategic rather than purely economic considerations.

How Is the Pentagon Restructuring America's Critical Mineral Strategy?

First-Time Direct Military Investment Approach

The Department of Defense has fundamentally restructured its approach to critical mineral security through direct equity investments in production infrastructure rather than traditional procurement contracts. This strategic shift positions the Pentagon as a partial owner and stakeholder in gallium production facilities rather than merely a customer purchasing materials through market mechanisms.

Pentagon equity investments in gallium production infrastructure include:

- $1.9 billion equity stake in Korea Zinc's Tennessee smelter operations

- $150 million investment in Atlantic Alumina's Louisiana refinery expansion

- Total Pentagon commitment: $2.05 billion across primary domestic projects

The Korea Zinc partnership represents the largest single investment, supporting a $4.7 billion total smelter expansion where Pentagon capital represents approximately 29% of project financing. This structure requires private sector companies to contribute majority capital whilst aligning government and private interests in project success through shared ownership.

Atlantic Alumina’s Louisiana facility expansion demonstrates the Pentagon’s focus on red mud waste processing technology, converting aluminum refining byproducts into strategic mineral resources. The $150 million Pentagon investment represents 33% of the $450 million total project cost, establishing similar risk-sharing ratios across different technology approaches.

Furthermore, this equity participation model creates fundamentally different incentive structures compared to traditional defense procurement. Rather than government bearing schedule and performance risks through purchase commitments, the Pentagon shares both financial risks and operational rewards with private sector partners.

Project Vault: Public-Private Stockpiling Initiative

Project Vault represents a strategic buffer stock programme designed to address gallium market volatility through counter-cyclical government purchasing. The initiative operates as a dual-purpose mechanism: preventing producer bankruptcies during price crashes whilst maintaining strategic reserves to prevent supply disruptions during geopolitical crises.

The stockpiling approach addresses fundamental market failures in critical mineral supply chains where:

- Small market size creates extreme price volatility

- Boom-bust cycles discourage long-term production investments

- Strategic importance exceeds commercial market incentives for supply security

Government buffer stock operations provide steady buyer support during market downturns, enabling producers to maintain operations and technical expertise rather than shutting down facilities during temporary price declines. Simultaneously, strategic reserves ensure supply availability during export restrictions or other supply disruptions.

This market stabilisation mechanism represents recognition that normal commodity market dynamics cannot provide adequate supply security for materials with strategic importance exceeding their commercial market size.

Which Domestic Production Projects Will Transform US Gallium Independence?

Alcoa’s Western Australia Partnership Model

Alcoa’s Wagerup refinery in Western Australia represents the most advanced gallium production project currently under development, with 100 tonnes annual production capacity targeted for late 2026 commissioning. The facility integrates gallium extraction into existing bauxite refining operations through a newly designed processing plant optimised for gallium recovery.

Project economics at current pricing levels indicate substantial profitability:

- Annual production: 100 tonnes

- Revenue potential: $170 million (based on current pricing trends)

- Profit margins: 70-80% projected at sustained pricing levels

- Annual profit potential: $110-136 million

Alcoa CEO William Oplinger emphasised the scalability of gallium extraction across the company’s refinery network. His assessment that gallium extraction represents an existing capability rather than novel technology development suggests current capacity plans may represent conservative estimates of potential production volumes.

The Wagerup facility demonstrates how bauxite processing integration can achieve gallium production without requiring dedicated mining operations. Since gallium occurs naturally as a trace element in bauxite ore, specialised processing technology can recover gallium as a co-product alongside primary aluminum refining.

This approach provides several strategic advantages: utilising existing mining and basic processing infrastructure, achieving economies of scale through integration with large-volume aluminum production, and reducing capital costs compared to standalone gallium extraction facilities.

Montana’s Sheep Creek Fast-Track Development

US Critical Materials’ Sheep Creek project in Montana represents domestic gallium production through accelerated permitting strategies designed to achieve 2026 volume production targets. The project benefits from defence-priority classification that expedites regulatory approval processes typically extending project development timelines. Fast-track permitting demonstrates government recognition that normal regulatory timelines conflict with strategic supply chain security requirements. Defence-priority status enables projects to receive expedited review processes whilst maintaining environmental and safety standards. However, the Montana project’s significance extends beyond immediate production volumes to establishing domestic precedents for critical mineral extraction permitting. Successful fast-track development could create frameworks applicable to other critical mineral projects requiring rapid deployment.Louisiana Red Mud Recovery Innovation

Atlantic Alumina’s Louisiana refinery expansion represents breakthrough waste-to-resource conversion technology, processing aluminum refining byproducts to recover strategic minerals whilst addressing environmental waste management challenges simultaneously.

Project specifications include:

- Annual gallium output: 50 tonnes from red mud processing

- Total expansion cost: $450 million

- Pentagon equity investment: $150 million

- Technology approach: Chemical recovery from aluminum refining waste

Red mud represents the solid waste byproduct of aluminum refining through the Bayer process, typically requiring expensive disposal in containment facilities. Atlantic Alumina’s expansion converts this environmental liability into productive gallium resource extraction, creating dual benefits of waste reduction and strategic mineral production.

The technology demonstrates how industrial waste processing can contribute to critical mineral supply security whilst addressing environmental challenges in aluminum refining operations. This approach could potentially scale to other aluminum refineries globally, expanding gallium recovery capacity without requiring new mining operations.

What Are the Economic Risks of Rapid Supply Chain Diversification?

Market Oversupply Concerns and Price Volatility

Economics Professor Ian Lange from the Colorado School of Mines warned that gallium’s small market size creates vulnerability to dramatic price crashes if multiple production projects achieve operational status simultaneously. His assessment suggests the current market could not absorb planned production increases without significant price corrections that could undermine project economics.

Market scale analysis reveals the magnitude of this concern:

- Global production 2024: 760 tonnes total

- Planned US capacity additions: 200+ tonnes annually from major projects

- Percentage impact: US projects could represent 25%+ of global supply

Finnish consultancy Rovjok projects 24% global demand growth by 2030, providing some support for capacity additions but potentially insufficient to absorb rapid supply increases without price volatility. The demand growth projection assumes continued expansion in semiconductor applications and 5G infrastructure deployment.

Cost disadvantage analysis indicates US gallium production costs exceed Chinese alternatives by 20% or more, creating vulnerability during price downturns. Higher production costs reflect several factors: smaller scale operations, higher labour costs, more stringent environmental standards, and lack of integration economies available to Chinese producers through massive aluminum refining operations.

In addition, price volatility creates particular challenges for projects requiring substantial upfront capital investments. Pentagon equity participation provides some buffer against market downturns, but private sector co-investors remain exposed to price risk that could affect project financing and operational decisions.

Scale Economics vs. National Security Trade-offs

Gallium production economics reflect fundamental tensions between commercial viability and strategic necessity. The mineral’s strategic importance far exceeds its commercial market size, creating situations where national security requirements justify investments that purely economic analysis might not support.

Investment recovery scenarios under different pricing assumptions reveal this tension:

- High pricing scenario ($1,200-1,600/kg): Strong returns supporting rapid expansion

- Normalised pricing scenario ($600-800/kg): Marginal returns requiring government support

- Price crash scenario ($300-500/kg): Negative returns without strategic value considerations

Pentagon equity participation acknowledges that strategic value calculations extend beyond pure economic returns. Defence applications for gallium justify supply security investments that commercial markets alone might not support, particularly during peacetime when strategic vulnerabilities remain theoretical rather than immediate.

The small scale of gallium markets compared to other critical minerals creates unique challenges. Whilst lithium or cobalt markets can support multiple large-scale producers, gallium’s limited total demand concentrates risks in fewer projects with higher individual impact on market balance.

How Do International Alliances Strengthen America's Gallium Strategy?

Australia-Japan-US Trilateral Framework

The Australia-Japan-US trilateral partnership for gallium supply security demonstrates how allied coordination can achieve strategic objectives beyond what any single country could accomplish independently. This framework allocates production from Australia’s refinery capacity among participant governments whilst sharing development costs and technological expertise.

Western Australia refinery output allocation provides each partner nation with guaranteed access to gallium supplies independent of Chinese export policies. The arrangement ensures supply security for all participants whilst enabling Australia to develop refining capacity that might not be economically viable for domestic demand alone.

Critical Minerals Ministerial coordination mechanisms enable rapid response to supply disruptions and coordinated development of alternative sources. Regular ministerial meetings provide forums for sharing intelligence on supply threats, coordinating strategic stockpile policies, and aligning investment priorities across allied nations.

Advanced mining technology investments totalling $355 million across the trilateral partnership focus on developing extraction and processing techniques applicable to multiple critical minerals beyond gallium. This technology sharing approach creates mutual dependencies that strengthen alliance relationships whilst advancing each nation’s mineral security objectives.

EU-US Critical Mineral Alliance Integration

The EU-US Critical Mineral Alliance expands gallium supply security cooperation beyond the Indo-Pacific region to include European allies facing similar Chinese supply dependencies. Joint sourcing initiatives enable coordinated purchasing that provides greater market leverage than individual national procurement efforts.

Technology sharing agreements for extraction and processing methods enable both American and European companies to access innovations developed across the alliance. This approach accelerates technology development whilst preventing duplication of research and development investments across allied nations.

Coordinated response strategies to Chinese export controls ensure allied nations present unified approaches rather than competing policies that could undermine each other’s effectiveness. Coordination prevents China from exploiting differences in allied policies through selective export restrictions targeting individual countries.

Consequently, the alliance framework demonstrates how strategic competition with China requires multilateral approaches that individual nations cannot achieve alone. Combined market power, technological resources, and political coordination create more effective responses to Chinese mineral export policies.

What Timeline Should Investors Expect for US Gallium Independence?

2026-2027 Production Ramp-Up Phase

Major project commissioning timeline establishes the sequence of domestic capacity coming online:

- Late 2026: Alcoa Western Australia facility commissioning (100 tonnes annually)

- 2026-2027: Montana Sheep Creek initial production volumes

- 2027: Atlantic Alumina Louisiana expansion completion (50 tonnes annually)

- 2030: Korea Zinc Tennessee operations full capacity (54 tonnes annually)

Pentagon equity project milestones provide checkpoints for measuring progress toward supply security objectives. These milestones include facility construction completion, pilot production achievement, quality specification validation, and full operational capacity demonstration.

The production ramp-up phase represents the critical period when theoretical capacity must translate into actual gallium output meeting defence and industrial quality standards. Technical challenges during this phase could affect timeline achievement and overall project success.

2028-2030 Market Rebalancing Scenarios

Domestic supply projections indicate US production could reach 10-15% of national consumption by 2030, representing substantial progress toward supply diversification whilst maintaining import dependence for majority requirements. This level of domestic production provides strategic buffer capacity whilst avoiding complete supply chain disruption during transition periods.

Allied nation contribution to total import reduction could achieve combined independence of 40-50% from Chinese sources when domestic and allied production are aggregated. This level of diversification significantly reduces strategic vulnerability whilst maintaining some trade relationships with China for economic and diplomatic reasons.

Price stabilisation expectations suggest gallium costs could settle in the $800-1,200 per kilogram range as new capacity comes online and market competition increases. This pricing level would support project economics whilst reducing costs for defence contractors and technology manufacturers.

Disclaimer: Timeline projections and production targets represent current plans that may be affected by technical challenges, regulatory approvals, market conditions, and geopolitical developments. Actual results may differ significantly from projected timelines and production volumes.

Why China's Response Could Reshape Global Critical Mineral Markets

Export Control Escalation Possibilities

Historical patterns from rare earth restrictions during 2010-2012 demonstrate China’s willingness to use critical mineral exports as foreign policy tools. Similar escalation in gallium restrictions could extend to complete export bans or significantly expanded list of restricted countries and applications.

Potential expansion to other critical minerals represents the broadest risk scenario, where China could leverage its dominant positions in lithium processing, cobalt refining, and rare earth production simultaneously. Coordinated restrictions across multiple critical minerals would create compound supply chain disruptions exceeding individual mineral impacts.

Furthermore, the escalating trade tensions and US-China trade impacts have accelerated Pentagon investment planning across multiple critical minerals beyond gallium. Defence Department strategic planning now assumes potential Chinese export restrictions across the full spectrum of materials required for advanced military systems.

The escalation dynamic creates pressure for rapid domestic capacity development before Chinese restrictions expand further. This urgency explains Pentagon willingness to accept higher costs and market risks for domestic production compared to continued import dependence.

Technology Competition in Processing Efficiency

Chinese cost advantages from integrated aluminum operations reflect decades of industrial development that created economies of scale difficult to replicate rapidly. Chinese gallium production benefits from massive aluminum refining capacity that treats gallium recovery as a secondary revenue stream rather than primary business objective.

US innovation focus on extraction from alternative sources, including zinc processing residues and red mud waste, demonstrates technological approaches that could eventually achieve cost competitiveness. American technological leadership in specialised extraction and purification technologies provides potential pathways to overcome scale disadvantages.

Automation and efficiency improvements represent the primary mechanism for closing cost gaps with Chinese production. Advanced processing technologies, artificial intelligence optimisation, and robotic systems could reduce labour cost disadvantages whilst improving yield and quality consistency.

The technology competition dimension suggests that gallium supply security ultimately depends on innovation and efficiency improvements rather than simply building more production capacity using existing methods. This drive for innovation connects directly with the broader big pivot in critical minerals strategy across the sector.

What Does This Mean for Defense Contractors and Technology Companies?

Supply Chain Security Improvements

Reduced single-source dependency risks represent the primary benefit for defence contractors currently reliant on Chinese gallium supplies. Domestic and allied production provides alternative sources that government agencies and prime contractors can specify for sensitive applications requiring supply security.

Domestic supplier qualification processes enable defence contractors to develop relationships with US-based gallium producers, creating supply chains that meet Department of Defense requirements for domestic content and supply security. These relationships provide competitive advantages for contractors emphasising supply chain resilience in proposal evaluations.

Long-term contract opportunities with US gallium producers enable defence contractors to secure supply commitments at predetermined pricing, reducing both availability and cost risks in long-term defence programs. Pentagon equity participation in production facilities creates additional assurance of supply priority for defence applications.

This supply chain transformation aligns with broader developments in the defense-critical materials strategy being implemented across allied nations, including Australia’s complementary approach to securing strategic mineral supplies.

Investment Opportunities in Critical Mineral Infrastructure

Pentagon equity participation models for other critical minerals beyond gallium provide templates for private sector partnerships with government backing across strategic material supply chains. Successful gallium projects could encourage similar approaches for lithium, cobalt, rare earths, and other critical minerals.

Private sector partnerships with government backing create investment opportunities that combine commercial returns with strategic importance. Pentagon co-investment reduces private sector risks whilst providing access to projects with national security priority and government support.

Regional processing hub development potential emerges as multiple critical mineral projects concentrate in specific geographic areas with supportive infrastructure, workforce, and regulatory environments. These hubs could achieve clustering benefits that improve economics for individual projects whilst strengthening overall supply chain resilience.

The broader implications extend to related sectors including semiconductor critical minerals and the evolving energy transition outlook that requires similar supply chain security measures. The US gallium strategy represents the initial phase of comprehensive critical mineral independence strategy that will create sustained investment opportunities across multiple strategic materials and processing technologies.

| Metric | Current Status | 2026-2030 Targets |

|---|---|---|

| US Import Dependence | 100% | 85-90% |

| Chinese Market Share | 98-99% | 80-85% |

| Domestic Production | 0 tonnes | 200+ tonnes annually |

| Pentagon Investment | $2.05 billion committed | Additional projects under review |

| Price Stability Target | $1,572/kg (volatile) | $800-1,200/kg range |

However, successful implementation of the US gallium strategy requires sustained commitment across multiple administrations and continued coordination with allied nations. The technical and economic challenges ahead remain substantial, but the strategic imperative for supply chain diversification continues to drive unprecedented government and private sector collaboration in critical mineral development.

Disclaimer: Market projections, investment returns, and timeline estimates involve significant uncertainties and risks. Actual results may differ materially from projected outcomes due to market conditions, technological challenges, regulatory changes, and geopolitical developments. This analysis is for informational purposes only and should not be considered investment advice.