Strategies for 2024

US Critical Materials strategy for growth includes development of our current properties, the continuing acquisition of new critical mineral properties within the U.S., creation of proprietary processing methods, commencement of a public relations campaign, the implementation of a government outreach program, and exploring financing options; including negotiating off take contracts and seeking end user investments.

-

Acquisition of Additional Properties

US Critical Materials is aware that there are certain high quality critical mineral properties in the U.S. that have not been identified and are available for acquisition. Management, along with the Company geologists, have been in the mineral space for many years and have identified certain promising targets. US Critical Materials plans to acquire several of these properties in 2024.

-

Metallurgical And Processing Studies

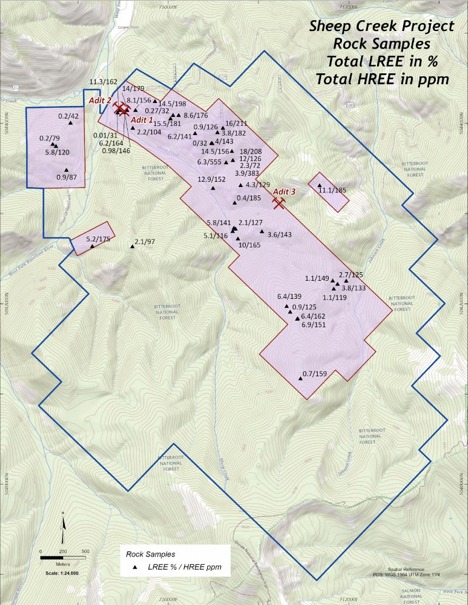

Idaho National Laboratories, Idaho Falls, Idaho, a division of the U.S. Department of Energy, has expressed an interest in examining rock from the Sheep Creek property to serve as a test-ore to develop improved methods for recovering rare-earth elements and other critical metals. Work will include mineral identification, distribution of elements in ore, and evaluating processing pathways including separation by gravity, separation by flotation, determining optimum grind-size, recovery through leaching, fractionation of elements, and flow-charts for multiple elements.

-

Public Relations

The company has retained a well-respected and highly regarded public relations firm with whom it is formulating its PR campaign to be executed in newsprint, digital media, and on TV. US Critical Materials is confident that this media exposure will create awareness for our domestic supply of rare earths.

-

Government Relations

US Critical Materials has retained an experienced and well-established government relations firm to seek funding from DOD, DOE, and other federal agencies. There is considerable funding available from the US government.

-

Capital Markets Funding

Based on the unprecedented demand, and limited supply of critical minerals, the Company is currently exploring many options regarding funding. US Critical Materials has been approached by funding sources and continues to seek the best scenario for the Company and its shareholders.

-

Offtake Contracts

The Company is confident that it will be able to execute forward offtake contracts based on the imbalance in the marketplace, and activity of competitors. The contracts could be broad or targeted to each of the Company's many critical minerals. Rare earths projects with significantly lower critical mineral levels are currently negotiating and signing contracts with major end users. The contracts are long term, and do not require production for a few years.

-

End User Investments

Due to the shortage of critical minerals, end users are investing at the beginning of the supply chain so they will not be shut out. Auto companies have recently been entering into contracts with, and have even been purchasing outright, mining companies with a focus on critical minerals. With the expected continuation of geopolitical volatility around the globe, and the ever-increasing need for a secure supply, we believe US Critical Materials will become an acquisition, JV, or other target for not only auto companies, but a variety of other end users.

Strategy Overview